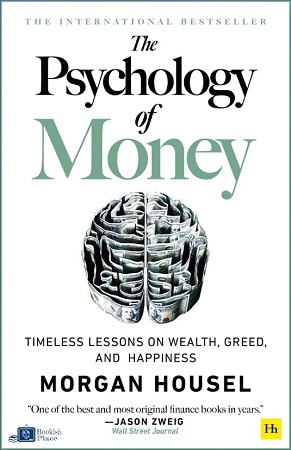

Mastering the Mind Game of Money: A Review of The Psychology of Money by Morgan Housel

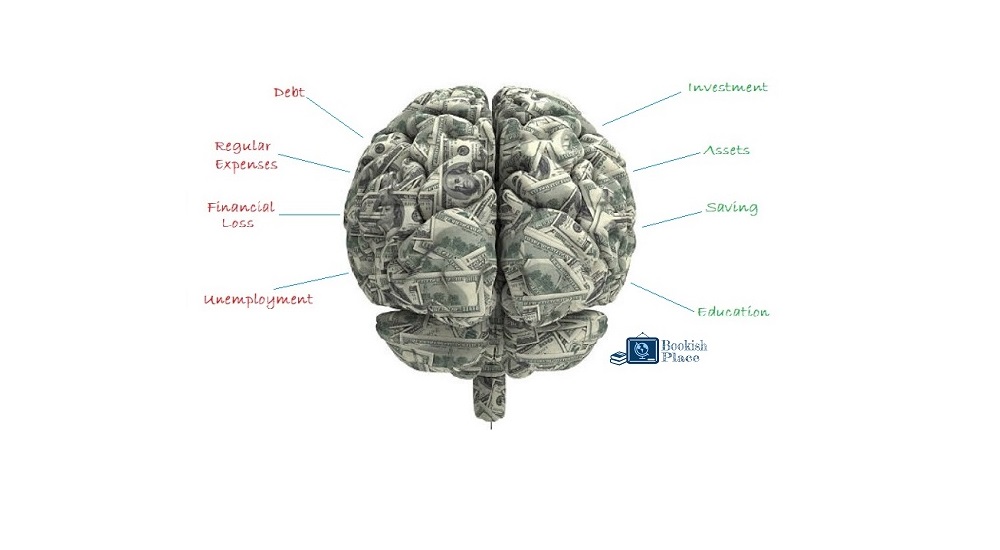

The Psychology of Money by Morgan Housel is one of the best books which discovers the science behind financial success. Money is a topic that often brings a mix of emotions – from excitement to anxiety, happiness to stress. Many people strive to accumulate wealth but struggle with managing it effectively. In his book, “The Psychology of Money,” Morgan Housel explores the intersection between psychology and finance and provides insights into the factors that influence our financial decisions.

In this article, we will review “The Psychology of Money” and highlight some of its key takeaways. We will delve into the behavioral biases that affect our money decisions, the role of habits in building wealth, and the power of emotions in financial decision-making. By understanding these concepts, readers can gain a deeper understanding of their own relationship with money and learn how to make more rational financial decisions. Whether you are a veteran investor or just a beginner in your financial journey, “The Psychology of Money” offers precious perceptions that can assist you master the mind game of money.

Contents

The Psychology of Money

Original Title: The Psychology of Money: Timeless Lessons On Wealth, Greed, And Happiness

Author: Morgan Housel

Language: English

Publisher: Harriman House

Publication Year: 2020

What is Money?

Money is a medium of exchange that is widely accepted in transactions for goods and services. It serves as a store of value, a unit of account, and a standard of deferred payment. The concept of money has evolved over time, from the use of barter systems to the development of standardized currencies.

Today, money can take many forms, including cash, bank deposits, digital currencies, and even commodities such as gold. The value of money is determined by supply and demand in the marketplace, as well as government policies and economic conditions. Despite its ubiquity, the nature and definition of money remain the subject of ongoing debate and study in economics and finance.

Most Common Myths About Money

Money is an integral part of our lives, and many people have strong opinions and beliefs about it. Unfortunately, some of these beliefs are based on myths and misconceptions that can lead to financial problems. Here are ten of the most common myths about money:

Money Is The Root Of All Evil

This phrase is often used to imply that money is inherently bad or corrupt. However, the full quote is “The love of money is the root of all evil,” meaning that it is the obsession with money that can lead to unethical behavior.

Money Can Buy Happiness

While money can certainly make life more comfortable, research has shown that it does not necessarily lead to greater happiness. Other factors, such as social connections and personal fulfillment, are often more important.

Debt Is Always Bad

Not all debt is created equal, and some forms of debt can be useful for achieving long-term goals. It’s important to distinguish between “good debt” (such as a mortgage or student loans) and “bad debt” (such as credit card debt).

You Need To Be Wealthy To Invest

Anyone can invest, regardless of income level. In fact, starting early and investing regularly can be more important than the amount invested.

You Need To Have A High Income To Be Financially Secure

Financial security is more about managing expenses and saving for emergencies than it is about income level.

Budgeting Is Too Restrictive

A budget can actually provide freedom and peace of mind by helping to prioritize spending and identify areas where expenses can be reduced.

You Can’t Make Money Doing What You Love

While not everyone can turn their passion into a lucrative career, it is possible to find work that aligns with your values and interests.

Money Is Too Complicated For Ordinary People To Understand

While financial concepts can be complex, there are many resources available to help individuals improve their financial literacy and make informed decisions about money.

You Need A Lot Of Money To Start Saving

Even small amounts of savings can add up over time, and the habit of saving is more important than the initial amount.

Wealthy People Are All Greedy

While there are certainly examples of wealthy people who prioritize personal gain over the common good, there are also many philanthropic and socially responsible wealthy individuals.

By dispelling these common myths and gaining a deeper understanding of personal finance, individuals can make more informed decisions about their money and work towards achieving their financial goals.

Summary of The Psychology of Money by Morgan Housel

“The Psychology of Money” by Morgan Housel explores the intersection between psychology and finance and provides insights into the factors that influence our financial decisions. The book is organized into 20 short chapters, each focusing on a different aspect of money and human behavior.

Housel argues that while financial knowledge and expertise are important, success with money ultimately comes down to understanding our own psychology. He provides numerous examples of how our biases, emotions, and life experiences can affect our financial decisions, often leading us to make irrational choices that ultimately harm our financial well-being.

One of the key themes of the book is the power of compounding, both in terms of financial returns and the benefits of forming good financial habits early on. Housel emphasizes the importance of patience, discipline, and long-term thinking in building wealth, and provides examples of how small, consistent actions can lead to big results over time.

Another key theme of the book is the importance of understanding risk and uncertainty in financial decision-making. Housel argues that risk is not just about the probability of losing money, but also about the potential consequences of that loss. He encourages readers to consider worst-case scenarios and plan accordingly, rather than simply relying on historical averages or assumptions about the future.

Throughout the book, Housel challenges common myths and misconceptions about money and offers practical advice for managing finances in a way that aligns with our personal values and goals. He emphasizes the importance of living below our means, avoiding debt, and investing in assets that provide long-term value.

Overall, “The Psychology of Money” is a thought-provoking and accessible read that provides valuable insights for anyone interested in improving their financial literacy and making more informed decisions about money.

Key Lessons of The Psychology of Money

“The Psychology of Money” by Morgan Housel is a thought-provoking book that explores the intersection of psychology and finance. Through a series of short chapters, the book offers valuable insights into the factors that influence our financial decisions, challenging common myths and offering practical advice for managing money in a way that aligns with our personal values and goals.

In the following, the article will explore the key lessons from “The Psychology of Money”.

No One’s Crazy

There are many different perspectives and approaches to money, and no one is inherently right or wrong. Housel argues that everyone has unique experiences and values that shape their attitudes towards money, which can sometimes seem illogical or irrational to others.

So, we should strive to understand and respect others’ perspectives on money, rather than judging or dismissing them. By recognizing that there are many different ways to approach financial decision-making, we can gain a more nuanced and empathetic understanding of ourselves and others, and make better choices that align with our values and goals.

Luck and Risk

One of the key lessons in “The Psychology of Money” is the role of luck and risk in financial success. Housel encourages readers to consider worst-case scenarios and to plan accordingly, rather than simply relying on historical averages or assumptions about the future. By understanding and managing both luck and risk, we can make more informed and effective financial decisions.

Never Enough

The key lesson of “Never Enough” is the danger of the mindset of constantly wanting more. Housel argues that humans are naturally inclined to always strive for more, but that this mentality can lead to destructive financial behavior.

He encourages readers to recognize that money and material possessions will never be enough to bring true happiness and fulfillment and that it is important to focus on finding contentment and satisfaction in life’s simple pleasures.

Getting Wealthy Vs Staying Wealthy

Building wealth is only half the battle; it is equally important to maintain and protect that wealth over time. Housel argues that this requires a long-term perspective and a willingness to prioritize financial security and stability over short-term gains or fleeting trends. He encourages readers to focus on sustainable and reliable sources of income, such as dividends and rental income, and to avoid taking on excessive risks or debt.

Freedom

Financial freedom is less about the amount of money we have and more about the amount of control we have over our lives. Housel argues that true financial freedom comes from having enough resources to support our desired lifestyle and to make choices based on our values, rather than being constrained by financial limitations or obligations. He encourages readers to focus on defining their own priorities and goals, rather than blindly chasing after societal or cultural expectations of success.

Confounding Compounding

Another key lesson of “Confounding Compounding” is the power of compound interest and the importance of starting to invest early. Housel argues that small, consistent actions can lead to big results over time, thanks to the exponential growth of compound interest. He encourages readers to prioritize saving and investing, and to take advantage of the power of time and compounding to build wealth over the long term.

Housel also stresses the importance of avoiding debt and living below our means, as these habits can free up more resources for saving and investing and ultimately lead to greater financial security and independence.

Man In The Car Paradox

The “Man in the Car Paradox” refers to the observation that we often judge people’s wealth and success based on their visible displays of wealth, such as a fancy car, rather than their actual financial situation. Housel argues that this paradox highlights the dangerous influence of social comparisons on our financial behavior and decision-making.

The key lesson here is that financial success is not determined by external markers of wealth or status, but rather by our ability to align our financial decisions with our personal values and goals.

Wealth Is What You Don’t See

“Wealth Is What You Don’t See” is a key lesson in “The Psychology of Money” that emphasizes the importance of focusing on the invisible aspects of wealth, such as financial security, peace of mind, and a sense of purpose, rather than solely on visible displays of wealth, such as luxury cars and designer clothing. Housel argues that true wealth is not just about accumulating money, but also about achieving a sense of contentment and fulfillment in life.

The vital lesson here is that it’s important to prioritize the things that truly matter to us, rather than focusing on external markers of success. By doing so, we can build a more meaningful and fulfilling life, even if it may not look impressive to others.

Reasonable or Rational

While we like to believe that we make rational financial decisions based on logic and data, in reality, our financial decisions are often driven by our emotions, biases, and social influences. Housel argues that it’s important to recognize and acknowledge our own limitations and biases when it comes to money, in order to make more informed and effective financial decisions.

The crucial lesson here is that being aware of our own cognitive and emotional biases can help us avoid making impulsive or irrational financial decisions, and instead make more reasoned and deliberate choices that align with our long-term goals and values.

Save Money

Saving is one of the most powerful tools for building long-term wealth and financial security. Housel argues that saving is not just about cutting back on expenses or living a frugal lifestyle, but also about adopting a mindset of prioritizing future goals over present desires. Small, consistent savings over time can add up to significant wealth and financial freedom. By developing a habit of saving, we can create a more stable and secure financial future for ourselves and our loved ones.

Surprise

Unexpected events and surprises are an inevitable part of life and can have a significant impact on our financial well-being. We can’t always predict or control the surprises that come our way, we can prepare ourselves to be more resilient and adaptable in the face of uncertainty. By embracing the unexpected, we can find ways to turn challenges into opportunities and create a more fulfilling and prosperous financial life.

Room For Error

Having a margin or room for error is crucial to achieving financial success and peace of mind. The significant lesson here is that by creating margin in our financial lives, such as by having savings, living below our means, and avoiding excessive debt, we can reduce stress and anxiety, and create greater flexibility and opportunity for growth. By building in room for error, we can also be better prepared to seize opportunities and bounce back from setbacks, ultimately leading to a more secure and satisfying financial life.

Nothing Is Free

There are always hidden costs or trade-offs associated with financial decisions, even when something appears to be “free”. Housel argues that understanding and considering these hidden costs is essential to making informed financial choices and avoiding expensive mistakes.

Thus, by being mindful of the true costs of our financial decisions, we can make more intentional and value-driven choices that align with our goals and priorities, ultimately leading to greater financial success and satisfaction.

You’ll Change

Our values, priorities, and goals around money are not fixed but are constantly evolving over time. Housel argues that our financial decisions are often influenced by our life experiences, and as we grow and change, our attitudes towards money may shift as well.

That’s why, we should not be too rigid in our approach to money, but instead, remain open to new ideas and opportunities that may arise as we move through different stages of our lives. By embracing change and adapting our financial habits to meet our evolving needs and values, we can make better decisions and build more fulfilling lives for ourselves and those around us.

The Seduction Of Pessimism

Pessimism can be seductive and alluring, but it can also be self-destructive and costly. Humans have a natural tendency to focus on negative events and potential risks, which can lead to overly pessimistic and defensive financial behavior, such as hoarding cash or avoiding the stock market altogether.

The key lesson here is that while it’s important to be aware of potential risks and downsides, an overly pessimistic mindset can hold us back from achieving our financial goals and miss out on potential opportunities. By focusing on a more balanced and realistic perspective, we can make more informed and confident financial decisions that can lead to greater long-term success and well-being.

The Psychology of Money – Book Review

“The Psychology of Money” by Morgan Housel is a thought-provoking and insightful book that challenges readers to rethink their relationship with money. Through a series of engaging stories and thought experiments, Housel explores the complex ways in which our emotions, biases, and life experiences shape our financial decisions, and offers practical advice on how to build a more fulfilling and financially secure life.

One of the book’s key strengths is its ability to communicate complex financial concepts in an accessible and engaging way. Housel has a talent for distilling complicated ideas into simple, relatable stories that resonate with readers. For example, he uses the story of the “Man in the Car Paradox” to illustrate the importance of focusing on the long-term implications of our financial decisions, rather than getting caught up in short-term gains or losses. Another standout chapter explores the concept of compounding interest, which Housel describes as the “eighth wonder of the world.” By breaking down the math behind compounding, Housel shows how even small, consistent investments can add up to significant wealth over time.

Another strength of the book is its focus on the psychological and emotional factors that influence our financial decisions. Housel argues that the way we think and feel about money is often more important than the actual amount of money we have. He provides numerous examples of people who have become wealthy despite starting with very little, as well as stories of individuals who have squandered fortunes due to poor financial decisions or a lack of financial literacy. Housel’s message is clear: no matter how much money you have, your mindset and behavior are the keys to building lasting wealth and financial security.

Perhaps the most valuable lesson of the book is its emphasis on the importance of living a fulfilling and purposeful life, rather than simply accumulating wealth for its own sake. Housel argues that money should be viewed as a tool for living the life we want, rather than an end in itself. He encourages readers to focus on the things that truly matter in life, such as relationships, experiences, and personal growth, and to use money as a means to support these values.

Overall, “The Psychology of Money” is an engaging and insightful read that offers valuable lessons for anyone seeking to build a more fulfilling and financially secure life. Whether you’re a seasoned investor or just starting out on your financial journey, Housel’s thoughtful and practical advice is sure to inspire you to think differently about your relationship with money. Highly recommended.

Books Like The Psychology of Money

The Psychology of Money explores the behavioral and psychological factors that influence our decisions around money and investing. Looking for books that explore the complex relationship between psychology and money? Check out these best-selling books.

- Nudge: Improving Decisions About Health, Wealth, and Happiness by Richard H. Thaler and Cass R. Sunstein

- The Behavioral Investor by Daniel Crosby

- The Four Pillars of Investing by William J. Bernstein

- Your Money and Your Brain by Jason Zweig

- The Simple Path to Wealth by JL Collins

FAQs

What is the price of the book “The Psychology of Money” by Morgan Housel?

The Psychology of Money price may vary depending on the format (hardcover, paperback, e-book, audiobook), the retailer, and the region. It’s best to check Amazon for the most up-to-date pricing information.

However, as a general guide, the price of “The Psychology of Money” can range from approximately $10 to $30 USD, depending on the format and retailer. E-books and audiobooks tend to be less expensive than physical copies.

How many pages does The Psychology of Money by Morgan Housel have?

The Psychology of Money pages consists of valuable lessons about how you should behave with money. The book written by Morgan Housel has 256 pages comprising 20 chapters.

The Psychology of Money author Morgan Housel is a prominent financial writer and partner at The Collaborative Fund.

To which genre does The Psychology of Money belong?

The Psychology of Money genre belongs to personal finance and self-help which explores the opportunity of investment and helps make a better financial decision.

When was The Psychology of Money Published?

The Psychology of Money by Morgan Housel was originally published on September 8, 2020, by Harriman House in the English language.

Conclusion

In conclusion, “The Psychology of Money” by Morgan Housel is an insightful book that provides a new perspective on personal finance and investing. By exploring the role of psychology in our financial decisions, Housel challenges traditional notions of wealth accumulation and encourages readers to adopt a more mindful and sustainable approach to managing their money. With engaging stories, real-life examples, and practical advice, the book offers a fresh and accessible take on financial literacy that is entertaining and informative. Overall, “The Psychology of Money” is a must-read for anyone interested in mastering the mind game of money and achieving long-term financial success.

Keep Reading, Be Bookish!

Dennis K. Hawkins is a writer, blogger, book critic and bookish person. He has written several books and regularly write blogs. As a bookish, he reads a lot and regularly share his opinion regarding books. Besides, he has a huge collection of unique accessories related to book. So, he is an expert and also a real user of the book accessories that he chooses to write on.